What is an FR-19 in Maryland?

The Motor Vehicle Administration in Maryland often requires clients to file an FR-19 or financial responsibility for car insurance. Separate from an SR-22, this form simply states that at a given point in time, you have the required auto insurance in Maryland for your vehicle. If you received one in the mail, contact us for assistance. For more information about auto insurance in Maryland, see About Car Insurance.

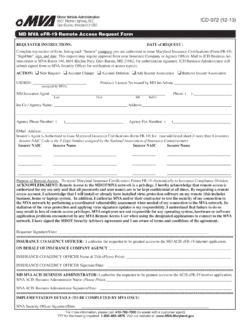

The form may look intimidating, but it’s actually fairly simple. We need to fill it out and send it to the MVA to show proof that you have valid driver’s insurance. It can be completed by your insurance agent to show proof of current MAIF car insurance that meets the Maryland minimum requirements.

If required, we can electronically file the FR-19 on your behalf. The form is only valid for 15 days and should be filed promptly. Our agents will work with you to ensure that this is completed in a timely manner to avoid possible penalties and fines.

How Do I Know I Need to File the FR-19?

There are certain situations that typically result in the requirement of an FR-19:

- Titling a new vehicle, see Title and Tag Services

- Dropped by an insurer or had a lapse in insurance

- Insurance audit from MVA

- Accumulating 3 or more points on a driver’s license

When establishing a My MD Auto Insurance policy with us, your agent will go over possible scenarios for being required to file an FR-19. We will help you determine if you are required to do so. If you are a current client and are concerned that you may need to file an FR-19, contact your My MD Auto agent today.